So You think Handling Your Own Payroll is Easy?

As if payroll itself wasn’t complicated enough, there are IRS reporting deadlines and deposit schedules to comply with as well. And, to make things ever more interesting, it can change depending on how your payroll changes through the year. How can a small business owner keep up with it all?

Teresa Ray, owner of The Payroll Department says that small business owners don’t have to struggle with all the rules and regulations if they outsource their payroll processing to a payroll service like hers. In fact, she says that this is one of the biggest reasons she hears from small business owners for making the decision to outsource to The Payroll Department.

What are you missing when you outsource your payroll?

Federal Forms 940, 941 and 944

According to the IRS resource guide, Form 941 must be filed on a quarterly basis and is due the last day of the month following the end of the quarter. Deposits must be made electronically if the Form 941 reports $2,500 or more in payroll taxes for the current quarter unless the prior quarter payroll taxes were less than $2,500. That means that a deposit may be required on quarter but not the next and vice versa.

According to the IRS resource guide, Form 941 must be filed on a quarterly basis and is due the last day of the month following the end of the quarter. Deposits must be made electronically if the Form 941 reports $2,500 or more in payroll taxes for the current quarter unless the prior quarter payroll taxes were less than $2,500. That means that a deposit may be required on quarter but not the next and vice versa.

Form 944 is an annual form reporting federal income tax withheld and the employer and employee shares of FICA taxes. It is due by Jan. 31 of the following year.

Form 940 is the Employer’s Annual Federal Unemployment Tax Return (FUTA) and must be filed annually by Jan. 31 of the following year. Deposits must be made if an employer has accumulated more than $500 in undeposited FUTA tax at the end of any quarter.

All deposits for payroll taxes must be made electronically.

Now we aren’t going to explain all the ins and outs of using the Electronic Federal Tax Payment System (EFTPS). Every employer must establish an account, get a PIN and have an Employer Identification Number. The system requires payment by phone or by internet and requires arrangements with your bank account to make transfers directly to the United States Treasury.

When are Deposits Due?

The IRS says that the easiest way to be sure you are in compliance is to make a deposit the same day you make payroll.

Deposit due dates are on a business-by-business basis. This is because the deposit schedule is based on prior years and the amount of taxes paid in the lookback period. If you have filed only Form 941, then your lookback period is a 12-month period ending June 30 of the prior year. If you have previously filed Form 944, then the lookback period is the second prior calendar year.

If you are a new employer and had no employees in the lookback period, the IRS automatically considers you a Monthly Schedule Depositor. Monthly deposits covering all paydays in a month are due by the 15th of the following month.

After determining the lookback period and reviewing the payroll taxes reported in that period, if the taxes totaled $50,000 or less, you are required to make monthly deposits. If the taxes totaled $50,000 or more, you must make semiweekly deposits. Deposits are due by the Wednesday or Friday following each payday, even if wages are paid only once a month. The actual day of the week is determined by the day wages are paid.

Deposits for FUTA taxes which have accumulated to $500 or more are due the last day of the month following the end of the quarter.

Adjustments to Forms 941 filed previously may change your deposit due dates. Also, any time you trigger the $100,000 Next Day Deposit Rule, your due dates and deposit schedule may change.

The $100,000 Next Day Deposit Rule and its effect on deposit due dates

The $100,000 Next Day Deposit Rule means that any time an employer accumulates a tax liability of $100,000 or more, that employer will be required to make deposits by the next business day. Once the $100,000 next day obligation is triggered, the employer must make deposits on a semiweekly schedule for the rest of the year and all of the following calendar year.

What’s the difference between filing reports and making deposits?

Only a lot! They are definitely not the same. Reporting is required by the due date for each form. But deposits may or may not be due at the time the reports are filed. Returns are reported and deposits are paid.

Also, please note that the deposit due dates do not refer to how often you pay wages to your employees, only to the rules that must be followed regarding tax deposits to the IRS.

What happens when you don’t report or deposit on time?

Penalties will be assessed AND interest will be charged. This can add up very quickly. The information from the IRS is concise, so here is the info directly from the IRS Resource Guide:

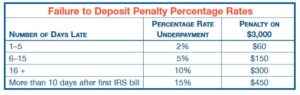

As you previously learned, it is important to make timely federal tax deposits because most of the money belongs to your employees. If you make these deposits late, you will receive a penalty. This penalty is called a “failure to deposit” penalty and is computed by multiplying the amount of tax you have underpaid by a penalty percentage rate based on how many days late you make the deposit.

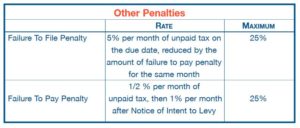

In addition to the above deposit penalties, you will also be subject to penalties if you file your Forms 940, 941, or 944 late, or don’t pay the amount due on the return.

Reminder: In addition to penalties, you also must pay interest. Interest rates are set quarterly. For example, the interest rate has recently varied between 3-6%. You will continue to pay interest until you pay all the money you owe the government.

A ten percent avoidance penalty is assessed if you do not deposit as required. The penalty is charged if you send a payment to the IRS when you are required to deposit. The avoidance penalty is assessed at the same time as the failure to deposit penalty, not in addition to the failure to deposit penalty.

Why take the chance?

It’s complicated – and this is just the fundamentals. If there are any adjustments or errors, it gets REALLY complicated. The Payroll Department handles payroll processing, reporting and deposits routinely. We know how to ensure accuracy and work through any changes with the agencies. You don’t need – nor do you probably want – any of the headaches. Join the ranks of small business owners who outsource this critical task to experts; contact Theresa at The Payroll Department to find out how to get started today!

-Elaine of the Payroll Department Blog Team