Civil Penalties for DOL Violations Increase January, 2017

In so many of our blogs we go on about the expense to small business owners when they don’t comply with reporting and deposit regulations when it comes to taxes and governmental reports and filings. It’s not because we want to scare you. It’s because we want you to see how quickly these penalties and interest can add up for one mistake – even if it is an inadvertent mistake.

Effective Jan. 13, 2017, Department of Labor (DOL) agencies, including the Employee Benefits Security Administration (EBSA) and the Wage and Hour Division (WHD), increased the cost of civil penalties for rules violations as required under the Inflation Adjustment Act.

Effective Jan. 13, 2017, Department of Labor (DOL) agencies, including the Employee Benefits Security Administration (EBSA) and the Wage and Hour Division (WHD), increased the cost of civil penalties for rules violations as required under the Inflation Adjustment Act.

While you might think this is all going forward since the effective date is January 13, 2017, many of the violations could have happened on or after November 2, 2015. Yes – that said 2015.

While there many changes, there are several that are of particular concern to small business owners and of which they should take serious note.

Part 578 – Minimum Wage and Overtime Violations – Civil Money Penalties

The penalty for each “repeated” and “willful” violation of that law’s minimum-wage or overtime requirements is increasing from $1,894 to $1,925 per failure (that means each instance of occurrence). The penalty is normally assessed per-person based upon the number of employees who were unlawfully paid. The violation can be deemed “willful” if the employer knew that it was in violation or acted with reckless disregard for whether it was.

Part 579 – Child Labor Violations – Civil Money Penalties

A penalty of $12,278 for each worker under 18-years-old who was employed in violation of the FLSA’s child-labor rules can be assessed against employers. If a child-labor violation results in a minor’s serious injury or death, the civil penalty is being increased to $55,808, and could be doubled to $111,616 if the violation is deemed repeated or willful.

Part 825 – The Family and Medical Leave Act of 1993

The penalty for not complying with posting requirements of the FMLA regulations is increasing from $163 to $166. Make sure the posters are placed in your workplace.

OSHA penalties have also increased in accordance with the Inflation Adjustment Act.

The 2017 maximum penalties for violations of OSHA regulations are as follows:

- Other-than-Serious: $12,675

- Serious: $12,675

- Repeat: $126,749

- Willful: $126,749

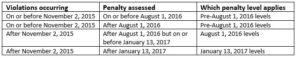

The timelines regarding the level of penalties to be levied based on the date of violation and when the penalty was assessed are as follows:

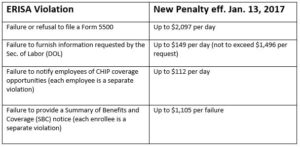

Failing to comply with Employee Retirement Income Security Act (ERISA) regulations can be quite costly. Penalties were increased in August, 2016 and then increased again effective January 13. Penalties for failing to furnish information, required notifications and failing to maintain necessary records are often assessed per employee, per day and can add up very quickly. Some of the changes employers need to know about include:

If just reading about the penalties makes your heart pound and your head spin, then outsourcing your payroll should be in your thoughts. It is not possible for most small business owners with employees to keep up with all the taxes, rules, and regulations from government agencies, the IRS, OHSA and DOL and the changes that come down the pike at an alarming level.

That’s why so many employers choose to outsource their payroll and reporting to The Payroll Department. We keep up on what payroll taxes, rules, and regulations are changing and keep you in compliance – so you don’t ever have to think about facing the penalties mentioned above.

Contact The Payroll Department owner, Teresa Ray, at to see what a weight we can remove from your shoulders. We want you to be able to sleep well every night so you have the energy and stamina to build your small business!

-Elaine of the Payroll Department Blog Team